Working with your own bankruptcy and you may looking to safer an enthusiastic FHA financing after Chapter thirteen personal bankruptcy are going to be an emotional process. On this page, we’ll getting discussing just how bankruptcy and FHA home loans might be acknowledged, with regards to the Section variation, within 12 months. Read on knowing exactly how Peoples Financial Mortgage can make suggestions through the total procedure and now have you well on your way on watching the fresh new light which shines at the end of your own tunnel to have their FHA Home loan.

Chapter 13 Bankruptcy proceeding and you will FHA Home loans

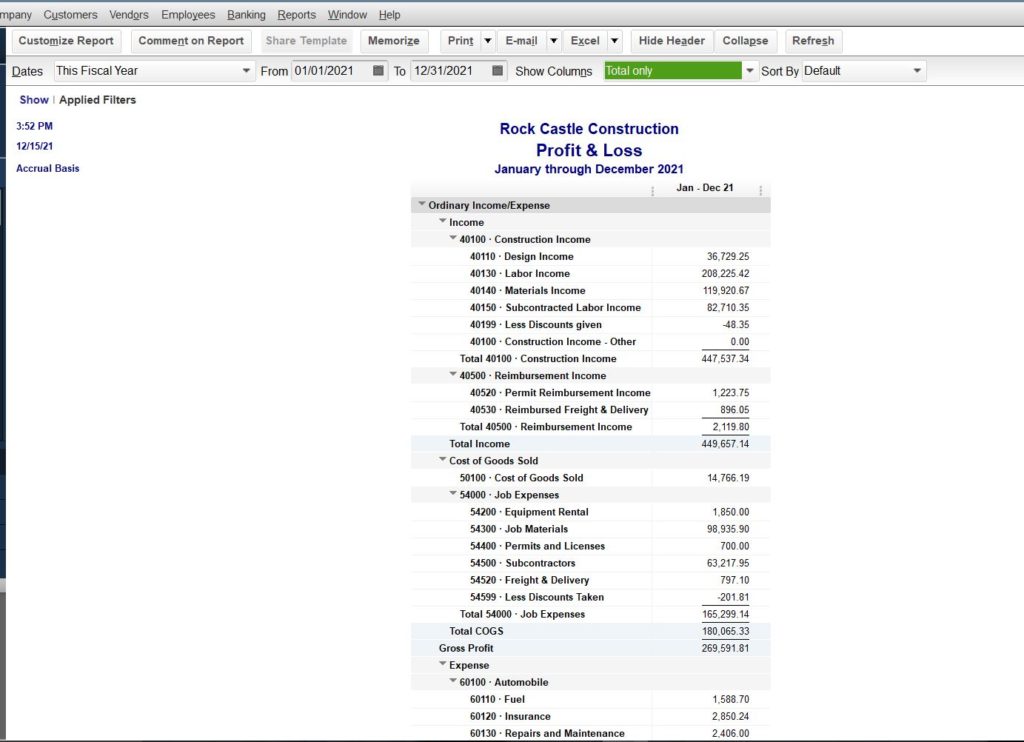

The FHA allows a borrower so you’re able to probably getting acknowledged getting a mortgage throughout the Chapter thirteen case of bankruptcy given the latest borrower made timely, verified money for around 1 year while some creditors will need a maximum of a couple of years just after released prior to recognizing a separate mortgage. Among conditions and terms of FHA financing while in Section thirteen ‘s the debtor isnt instantly capable sign up for a the FHA financing. The new court trustee’s authored recognition ‘s the qualifying reputation of your own the latter coverage. The fresh new borrower must provide an explanation out of as to why they’re asking for good financing in their Part thirteen Case of bankruptcy. At the same time the fresh borrower need certainly to fill out its FHA house application for the loan. To help be eligible for the borrowed funds itself, the brand new debtor must have satisfactory credit, a position, along with other monetary certificates.

One of the biggest difficulties with delivering a keen FHA mortgage once Part thirteen bankruptcy proceeding, is the insufficient experience of the borrowed funds benefits in speaing frankly about trouble aren’t develop into the mortgage process. New repayments inside package loans Skyline AL are often tough to make sure, and many of the things that that have been removed regarding bundle commonly obvious toward FHA underwriters that have to agree new loan. Other the most common is actually term discrepancies and you may bankruptcy proceeding relevant borrowing from the bank items with developed through the or adopting the Part thirteen plan. You will need to find a financial one to understands an average dangers and the ways to properly navigate them.

Chapter 7 Case of bankruptcy and you will FHA Mortgage brokers

Chapter 7 Personal bankruptcy is a little different from a section thirteen Bankruptcy since the a section eight Bankruptcy proceeding necessitates the borrower to go to into the FHA’s seasoning several months. This era of energy is actually a minimum of 2 yrs, as well as any extra day used by the bank once evaluation. Some financial institutions will require all in all, 36 months ahead of obtaining a special financial. On the whole, a section seven Personal bankruptcy need a longer time period than just a section 13 Bankruptcy proceeding timeline.

Any kind of Most other Money I can Score Throughout the or Just after Bankruptcy?

You will find usually other mortgage car what type will get be eligible for, an important is always to analyze and that choices are available and you will contrast. FHA, Va, USDA and some old-fashioned refi choices are often the best solutions on the lower rates and most favorable terms and conditions. Yet, other hard currency loan providers are also available in the event the no other solutions are present. . I at Peoples Lender Mortgage would suggest to very carefully look at the one and all sorts of choice mortgage possibilities you can favor and employ their better advice if you accidentally like a separate sort of credit. All of our professionals at Individuals Bank Home loan perform the most useful to strongly recommend more proper loan for your requirements with favorable terms and conditions it is possible to.

Favor Peoples Financial Financial to greatly help browse the fresh new FHA financing techniques after Personal bankruptcy

After you choose Peoples Bank Home loan to help you get an FHA loan after Part thirteen Case of bankruptcy, there are our solutions becoming best-notch and you will focused on delivering visible results from the really expedited style. Please e mail us for additional information on all of our FHA mortgages along with other choices and why you should prefer us over other organizations within globe. We’re going to make sure to reply to your inquiry the moment you can easily. We look ahead to hearing away from you in the near future!