The financial institution will likely then see your overall economy by the examining their yearly money, annual expenses, outstanding expenses and you can credit rating

- When you’re at this time acquiring treatment or rehabilitation solutions from the a great medical or society facility, you could today love to provides these types of providers considering on your the individual quarters by home healthcare professionals. Otherwise, in the event the continuous for procedures on an enthusiastic ambulatory facility is the better for your requirements, you can now arrange transportation to and from you to facility and your residence, constantly funded by your scientific disability insurance coverage.

The bank will then take a look at your general economic situation from the checking the yearly earnings, annual expenditures, the costs and you can credit score

- Homeownership includes a tremendous sense of freedom and liberty. Given that a homeowner, you reach arranged ramps, handle bars, bedrooms and you may shower enclosures towards the disabled throughout your house, as needed. You can design your time as you wish, top a casual life than simply is commonly possible when you look at the an excellent breastfeeding facility otherwise category household.

The financial institution will view your general economic situation by checking the yearly money, yearly expenses, a fantastic bills and you can credit rating

- However, since the a different sort of homeowner which have no less than one private disabilities or impairments, acquiring the set of your own local location will assist the bedding when you look at the chronilogical age of a special domestic. Such as, make an effort to become familiar with characteristics and you can amenities easily in your area and related society. Is actually public and you will/otherwise personal transportation plus readily available and easy to view? Carry out areas, sites, pharmacies and you will provider people render birth out-of restaurants, attire, pills, domestic and appliance maintenance provides whenever questioned? Were there smooth sidewalks and simple strolling parts without stages in social components near your residence? Are wheelchair accessibility commonly readily available, if needed, during the property try to get into and you can leave? Eg complications with instantaneous benefits and you will advantages, along with monetary inquiries, might be talked about and fixed better prior to their circulate toward brand new home, by the contacting a professional, knowledgeable housing specialist.

The financial institution will then view your overall economy of the checking your annual income, yearly expenditures, a fantastic expenses and credit score

- The key monetary inquiries might today face because a house proprietor with a disability can seem some daunting if you find yourself dealing with them alone. Yet, towards the expert advice out-of the best housing specialist, of a lot possible difficulties might be eliminated completely or taken care of rapidly and you can effectively.

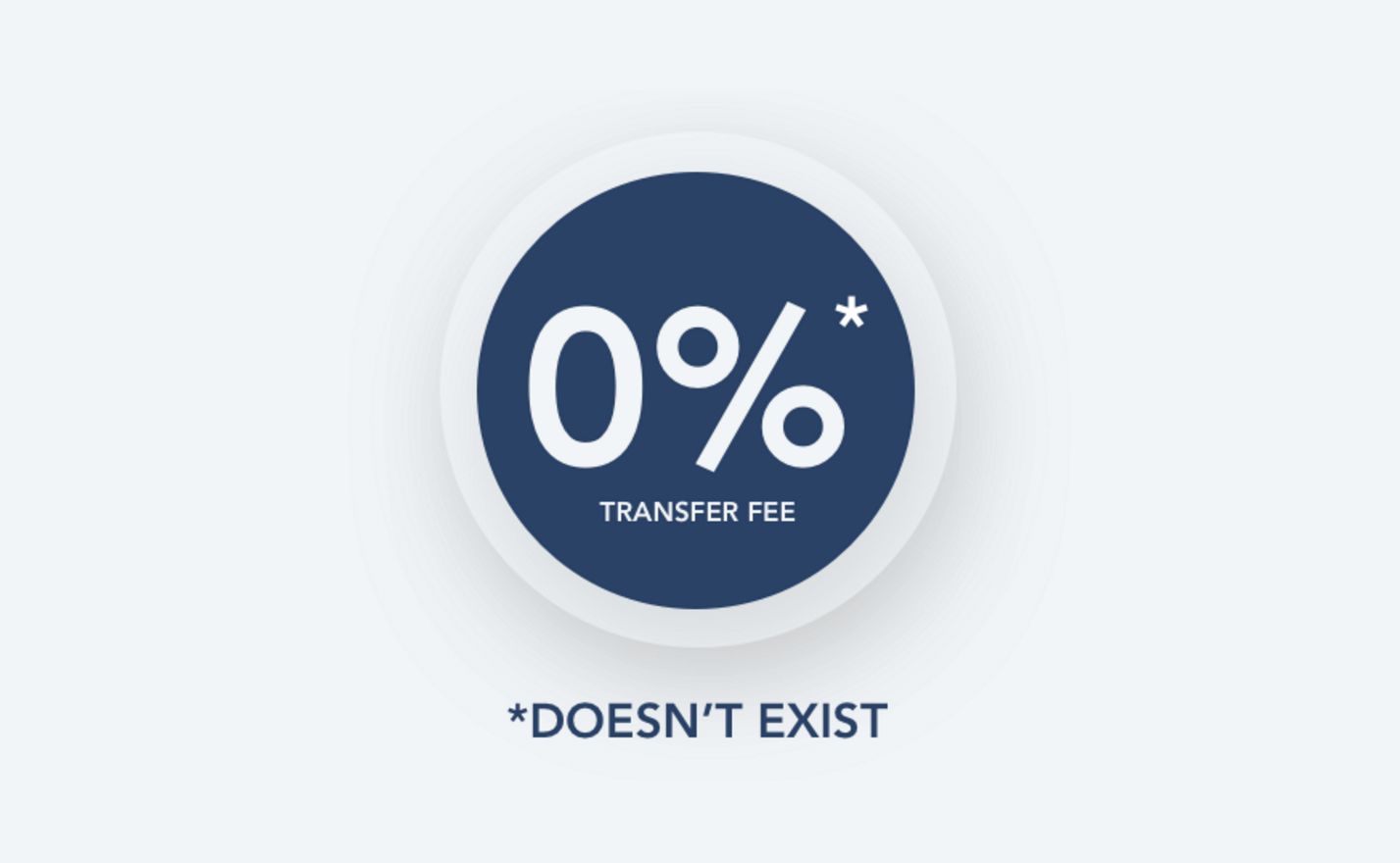

In the Bank: Along with your housing counselor is speak to your financial to utilize to possess an interest rate. As you are handicapped, your revenue and other financial data may vary considerably online personal loans TN of those individuals regarding someone else on the age group who are not handicapped. The construction counselor can be helpful inside explaining your special means and you can restrictions that affect specific numbers in your economic character. If this sounds like very first home loan app, your own counselor and you may financial loan administrator may assist in your full comprehension of loan down repayments, financial pricing (otherwise interest levels), monthly principal costs and additional lingering costs. Your specialist may also be helpful you can see most other appropriate educational funding programs to supplement and boost your full financial situation. (Among the better advised houses advisors is for your needs as a consequence of HUD, the new Institution off Homes and you may Urban Advancement.)

Classification your needs: Next, you, your therapist, and perhaps their M.D., a nurse or home care staff member who totally understands your trouble, want to make a whole range of your special demands in order to see which household particular and you can interior design will best meet your everyday standards. Should you get pre-qualified for a mortgage, this can enable you to find out an authentic imagine off just how far you can reasonably manage to invest in a home along having any expected precious jewelry and you may renovations. And you can, most importantly of all, be aware that particular mortgage loan agencies plus financial loan officers will most likely not offer a complete set of mortgage solutions simply because of the particular handicap.