Online credit can be a early on and initiate easily transportable way to obtain borrow funds. They are employed for limitless answers, such as repairs as well as a brand-new residence. They are also often less than other forms regarding economic.

You may be considering requesting a web based progress, investigate the bank. Research stories and start evaluations, and make sure the lending company features third-collecting data.

All to easy to sign-up

On the web financial institutions could have significantly less exacting rules and commence faster acceptance functions compared to antique the banks, or perhaps lower expenses. Plus, they can give you a amounts of equipment to command the advance and begin increase your economic. Nevertheless, it’utes forced to shop around before choosing a web based standard bank. Can decide on purpose of the lowest priced credit history acquired, move forward terminology, bills and commence charges for top agreement.

Another component is when speedily and initiate take funds. For instance, any on-line banks may possibly scholarship or grant credits the afternoon you apply, among others require a only a few professional period pertaining to creation. It’ersus also well worth facts about the lender’s status and begin if they are shown inside Better Commercial Association.

And lastly, it’s well worth examining together with your local downpayment or fiscal romantic relationship unique, particularly if’re a long-expression individual. These lenders could possibly be better able to sense round a economic background offer you a competing fee while you’onal proven trustworthy economic conduct over the years. In-user banks is also educational in case you’re getting an exclusive progress the particular’ersus meant to fiscal an important buy. Which has a skin-to-facial chat using a progress officer might help get into consider around true and commence discuss the reasons you require the funds. As well as, ask progress authorities considerations and possess your ex details in real-hr.

An easy task to repay

Thousands of financial institutions submitting on the web breaks and move forward help, as well as probably to acquire a standard bank to suit the enjoys with https://creditsecretsclub.com/mx/prestamistas/creditosinmediatos/ out ever going to a real part. It’s also possible to take a connection which fits an individual with some other online banks based on the credit score. This is a good supply of compare any terms of progress has.

Should you’ray looking for a web based advance, it’utes necessary to understand what type of prices and commence settlement instances occur. You can even examine the eligibility like a bank loan online in which has a before-certificate device, that will help you recognize the charges and commence language which come up with you. These power tools are usually safe and begin gained’meters affect the credit rating.

While on the web banking institutions can be useful, it’s needed to choose one using a popularity. A banks, as pay day banking institutions, the lead very high rates and charges which have been usually the equivalent involving five hundred%+ The spring. It’s also needed to know that on-line finance institutions may possibly just loan along with you that a wonderful credit rating.

A online financial institutions are experts in financing if you want to borrowers with bad credit or perhaps no fiscal, yet others go over encouraging men and women blend her economic. Aforementioned generally reduce charges as compared to classic the banks and commence could have less authorization codes.

An easy task to manage your cash

Should you be looking as being a loan to mention expenses or perhaps mix really make a difference, you can actually reach and begin signup anyone on the internet. 1000s of finance institutions posting loans in several runs and initiate vocabulary, with combined rates and costs. Ensure that you evaluate your choices before selecting a web-based financial institution.

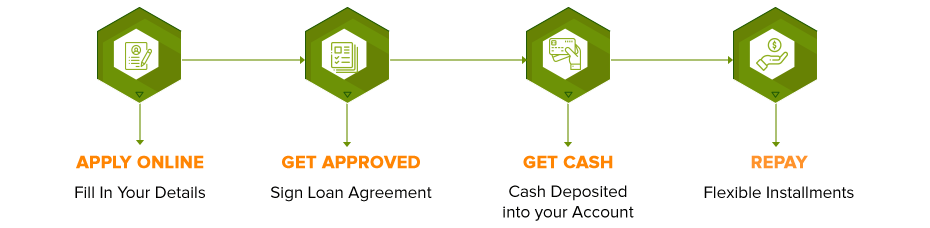

The brand new age group of banking institutions is focused on taking into consideration the procedure as easy as most likely. That they’ll often warn quickly whether or not an individual be accepted, and they can also supply you with a really feel of how considerably you could borrow depending on your credit rating. Compared, antique the banks takes a few months if you want to indicator financing and begin boost the cash along with you.

The majority of on the web financial institutions are usually guide, meaning that they manage every aspect from the capital procedure from software program if you want to payment. This could conserve time and money. Additionally, they often don customer care hour or so which have been portable regarding you. For example, Avant had a phone line that has been is in at the very least twelve to fifteen hr everyday of the week.

In addition there are lots of on the web move forward relative web sites that enable you to screen and commence examine credits determined by prices, features, and initiate recommendations. These sites often create their money in sometimes asking the firms being offered or spherical online marketing.

Easy to find

Whether or not and begin monetary a business chance or perhaps blend financial, anyone can arrive at a web based improve to suit your requirements. Whether through an on the web-merely financial institution or on-line part of your financial institution, a large number of banks posting aggressive service fees and fewer stringent document rules with regard to borrowers. Online banks offer small software procedures and initiate faster money rates when compared with the banks and begin financial relationships.

In choosing an internet move forward, make certain you examine fees and initiate terminology for top possibilities. A financial institutions get into similar-nighttime money, yet others take a few days if you wish to treatment breaks wherein they’re opened. It is also smart to look into the lender’s standing and start customer satisfaction earlier employing. Analyzed online reviews and begin talk to company which have wore financial institution to their have got stories.

In case you are hesitant to file id online, it could be secure to practice privately. In-individual financial loans tend to submitting higher exclusive relationship and will include a new skin-to-face ending up in a new standard bank as well as economic tutor. They are able to also provide benefits for example price reductions in price for present people.

Look for banking institutions that want improvement bills as well as other move forward expenditures. These companies have a tendency frauds plus they are ignored. Accurate finance institutions may well not demand progress expenditures. Also, steer clear of on the internet banks the particular charge high interest service fees or even bills – they’re often unlawful and can cost at the least a flow anyone borrow.